🧠 Watch: Why Smart Money Always Wins

There is only one mathematical difference between a professional trader who retires wealthy and a gambler who blows up their account: their adherence to strict Risk Management Trading protocols.

Most beginners focus entirely on “Entry Signals.” They obsess over exactly when to buy, looking for the perfect “Golden Cross” or indicator signal. But professionals focus 90% of their energy on how much to buy. They know that even the best Risk Management Trading strategy will have losing streaks. If you don’t survive the losing streak, you can’t profit from the winning streak (the power of Compound Interest works both ways).

Risk isn’t just about math; it’s about security. Always use a secure Trading VPN when trading on public Wi-Fi.

Enter the Golden Rule of survival that every Wall Street desk follows: The 2% Rule.

The 2% Rule Explained

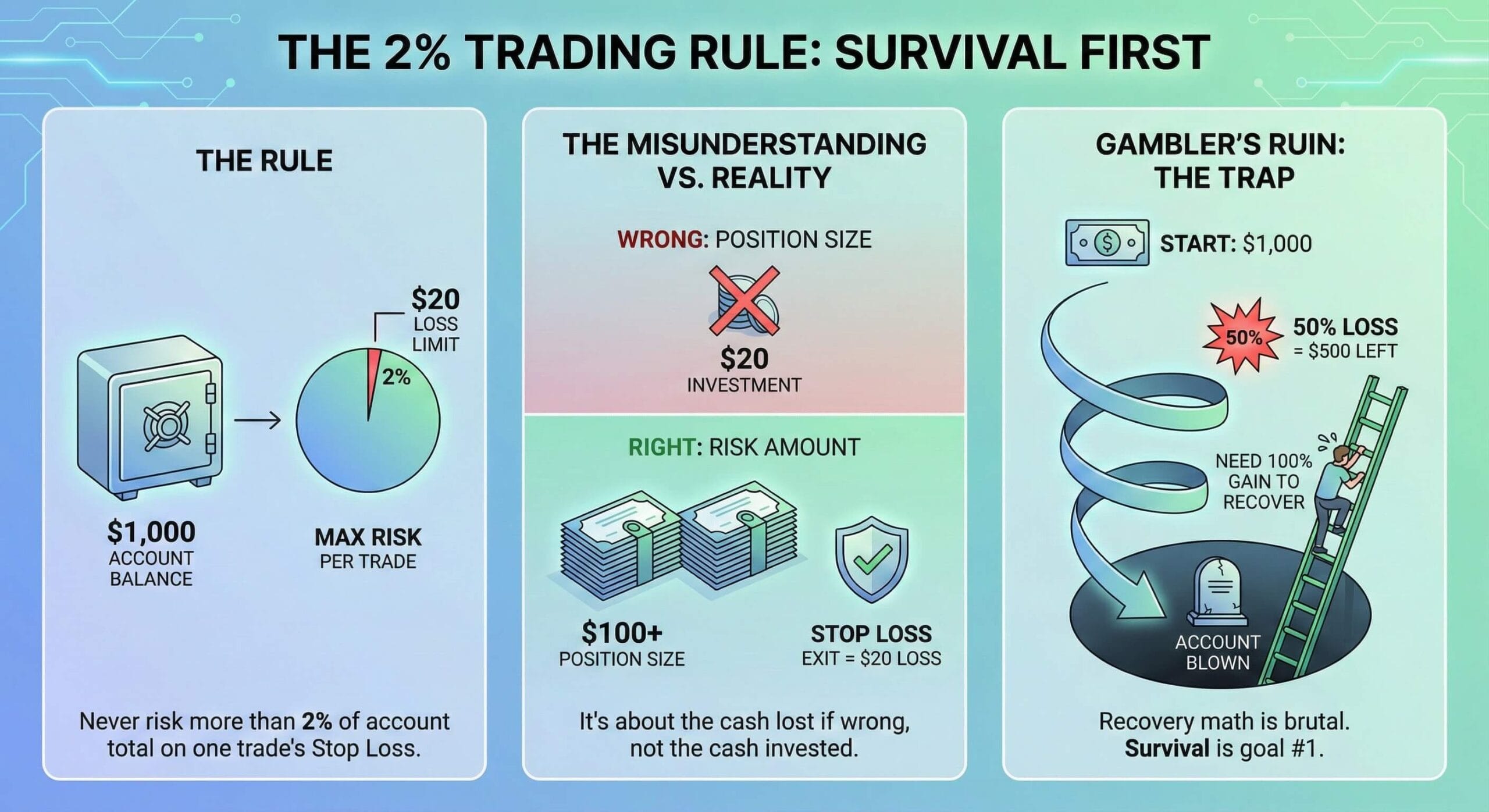

The rule is simple but non-negotiable: Never risk more than 2% of your total account balance on a single trade.

This does not mean you only buy $20 worth of stock with a $1,000 account. That is a common misunderstanding in Risk Management Trading circles. It means if the trade hits your Stop Loss and you exit, the actual cash loss should not exceed $20.

The Math Breakdown:

- Account Size: $1,000

- Max Risk Per Trade: $20 (2%)

If you stick to proper Risk Management Trading principles, you could be wrong 10 times in a row and still have 80% of your capital left. You are still in the game. If you risk 20% per trade, those same 10 losses would leave you with nothing.

The Mathematical Trap: “Gambler’s Ruin”

What happens if you ignore this advice and risk 10% or 20% per trade? You face a statistical certainty known as Gambler’s Ruin.

The math of recovery is brutal. If you lose 50% of your account, you don’t need a 50% gain to get back to breakeven. You need a 100% gain.

- Start with $1,000. Lose 50% = $500 left.

- To get back to $1,000, you need to make $500 profit.

- $500 profit on a $500 account is a 100% return.

Risk Management Trading isn’t about limiting your upside; it’s about eliminating the “blow-up” risk that destroys 90% of retail accounts in their first year. You cannot compound money you have already lost.

The Other Half: Risk-to-Reward Ratio

Limiting risk is only the “Defense.” To make money, you also need “Offense.” This brings us to the partner of the 2% Rule: The Risk-to-Reward Ratio (R:R).

Many amateur traders risk $50 to make $50. This is a 1:1 ratio. To be profitable here, you have to be right 51% of the time. Given that markets are chaotic, maintaining a >50% win rate is incredibly difficult even with advanced Risk Management Trading software.

Smart Money Trading works differently. Professionals look for 1:3 setups.

- Risk: $50 (The 2% Rule)

- Reward: $150 (Target Profit)

The Magic Math: If you trade with a 1:3 ratio, you can have a win rate of only 30% and still be profitable. You can be “wrong” most of the time, but because your winners are 3x bigger than your losers, you still make money.

How to Calculate Position Size (Step-by-Step)

To follow the 2% Rule, you must calculate your position size before you click buy. This is where most lazy traders fail their Risk Management Trading plan.

You can use professional charting tools like TradingView to measure your Stop Loss distance instantly, or simply use our free Position Size Calculator.

- Determine your Stop Loss: Look at the chart. Where is the trade invalid? (e.g., below the recent swing low).

- Measure the Distance: Let’s say your Stop Loss is 5% away from your entry price.

- Calculate the Amount: If you have a $1,000 account, your Max Risk is $20. You need to buy an amount where a 5% drop equals $20.

- The Calculation: $20 / 0.05 = $400.

Result: You buy $400 worth of the asset. If it drops 5%, you lose exactly $20 (2% of your account). This is the discipline required for successful Risk Management Trading.

Professional brokers like Exness offer tools to automate this calculation, but you should always understand the math yourself.

Risk Management Trading FAQs

What is the 2% Rule in Risk Management Trading?

The 2% Rule in Risk Management Trading states you should never risk more than 2% of your total account equity on a single trade. If you have $1,000, your stop loss should not lose you more than $20.

What is a good Risk to Reward ratio?

Professional traders aim for a minimum of 1:2 or 1:3. This means risking $1 to make $3. With a 1:3 ratio, you can be profitable even with a win rate as low as 30%.

💡 Related Strategy: Now that you know how to manage risk, you need to know where to enter. Read our guide on Smart Money Trading Indicators to stop using retail traps like RSI.

🚀 The “Risk Management” Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth.