There is a reason 90% of retail traders fail, while Smart Money Trading desks at major banks generate billions in consistent profits. It isn’t luck. It’s the tools and strategies they use.

“Broke Money” (Retail Traders) obsess over colorful lines on a chart—RSI, MACD, Bollinger Bands. They try to predict the future using lagging data from the past.

“Smart Money” (Institutions) ignores all of that. They trade based on one thing: Liquidity. If you want to stop donating your money to Wall Street, you need to stop trading like a retailer and start thinking like a Market Maker.

But first, realize that Smart Money Trading firms don’t gamble. They use strict risk controls. Learn the 2% Risk Rule before you try to copy their trades.

The “Lagging Indicator” Trap

Most beginners open a chart and immediately plaster it with indicators. They wait for the RSI to be “oversold” or the MACD to “cross over.”

The problem? These are Lagging Indicators. They only tell you what price has already done, not what it is about to do.

By the time your indicator gives you a “Buy” signal, Smart Money Trading algorithms have already entered the trade, taken their profit, and are looking to sell their bags to you. You are literally the “Exit Liquidity” for the pros.

How Smart Money Trading Algorithms Actually Work

Institutional trading is about moving massive amounts of capital without slipping the price too much. To do this, they need liquidity. They need a lot of people selling so they can buy (or vice versa).

The Smart Money Trading Strategy (Liquidity Grabs):

- They identify obvious “Support Levels” where retail traders put their Stop Losses.

- They push the price just below that level to trigger all those stops (creating a flood of sell orders).

- They buy into that flood (taking the other side of your stop loss).

- The price instantly reverses and rockets up.

You call this a “Fakeout.” They call it “Acquiring Liquidity.” This is the core of Smart Money Trading.

🧠 Watch: Retail vs Institutional Trading

The 3 Phases of the Market Cycle

To truly align with the banks, you must identify which phase the market is in. The Smart Money Trading cycle operates in three predictable steps:

- Accumulation: The “boring” phase. Prices move sideways in a tight range. Institutions are quietly buying small amounts to build a massive position without alerting the market. (This is similar to how Compound Interest works—slow at first, then explosive).

- Manipulation (The Stop Hunt): The rapid move against the trend. If they want to go Long, they will suddenly crash the price to induce panic selling (and hit stop losses). This provides the liquidity they need to fill their massive buy orders.

- Distribution: The markup. Once their orders are filled, they let the price fly. This is where retail traders typically “FOMO” in, buying the top just as Smart Money starts selling for profit.

Volume is the Only Truth

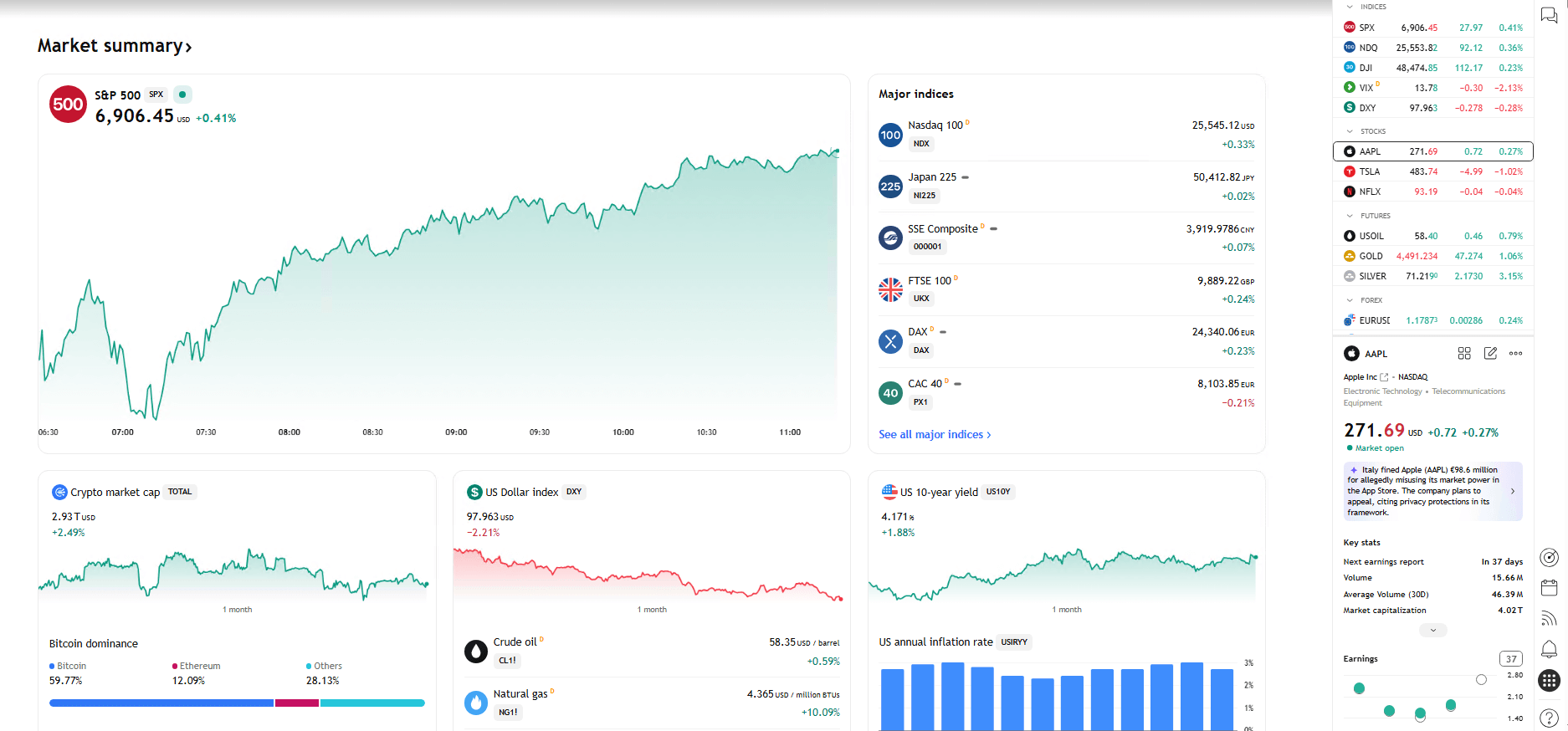

If you want to track Smart Money Trading activity, you only need two tools: Price Action and Volume.

Volume does not lie. If the price moves up but the volume is low, it’s a trap. If the price crashes with massive volume, the whales are selling. You need professional charting software to see this data clearly.

To see real institutional volume (not just tick data), you need a regulated broker with direct market access. We recommend Exness for its raw spreads and transparent volume data.

Smart Money Trading FAQs

What is Smart Money in trading?

Smart Money refers to institutional capital—banks, hedge funds, and market makers. They control the majority of volume and move the market, often trapping retail traders to acquire liquidity.

What is the best indicator for Smart Money?

Smart Money traders rarely use lagging indicators like RSI. The best tools are Price Action (Market Structure) and Volume, which show where institutions are buying and selling in real-time.

How do I spot a liquidity grab?

Look for a rapid price move that breaks a clear support/resistance level but immediately reverses. This “fakeout” is usually institutions triggering stop losses to fill their orders.

🚀 The Smart Money Trading Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth. Want to see the hardware pros use? Check out our Professional Trading Desk Setup.