Affiliate Disclosure: I have a Coinbase account that I use to evaluate crypto platforms from a security and usability perspective. This review is based on hands-on access and infrastructure analysis, not financial advice. Some links in this article may be affiliate links.

Coinbase Review 2026: Is It Really Worth It for US Crypto Beginners?

Transparency first: I opened a Coinbase account in November 2025 to evaluate the platform’s security, interface, and setup process. I have not funded the account or executed trades yet, as my focus has been on understanding the platform before committing capital.

This Coinbase Review 2026 is written from the perspective of a learner and a DevOps engineer who prioritizes security, compliance, and system behavior over speculation or trading hype.

👉 Open a Coinbase Account (Official Link)

If you are still in the research phase, you may also want to read my TradingView Review 2026, where I explain how beginners can analyze markets before placing trades.

Coinbase Review 2026: Regulatory Compliance & Trust

Coinbase is a publicly traded company (NASDAQ: COIN) and operates under US regulatory oversight. Unlike offshore exchanges, Coinbase follows KYC, AML, and reporting requirements enforced by US regulators such as the SEC.

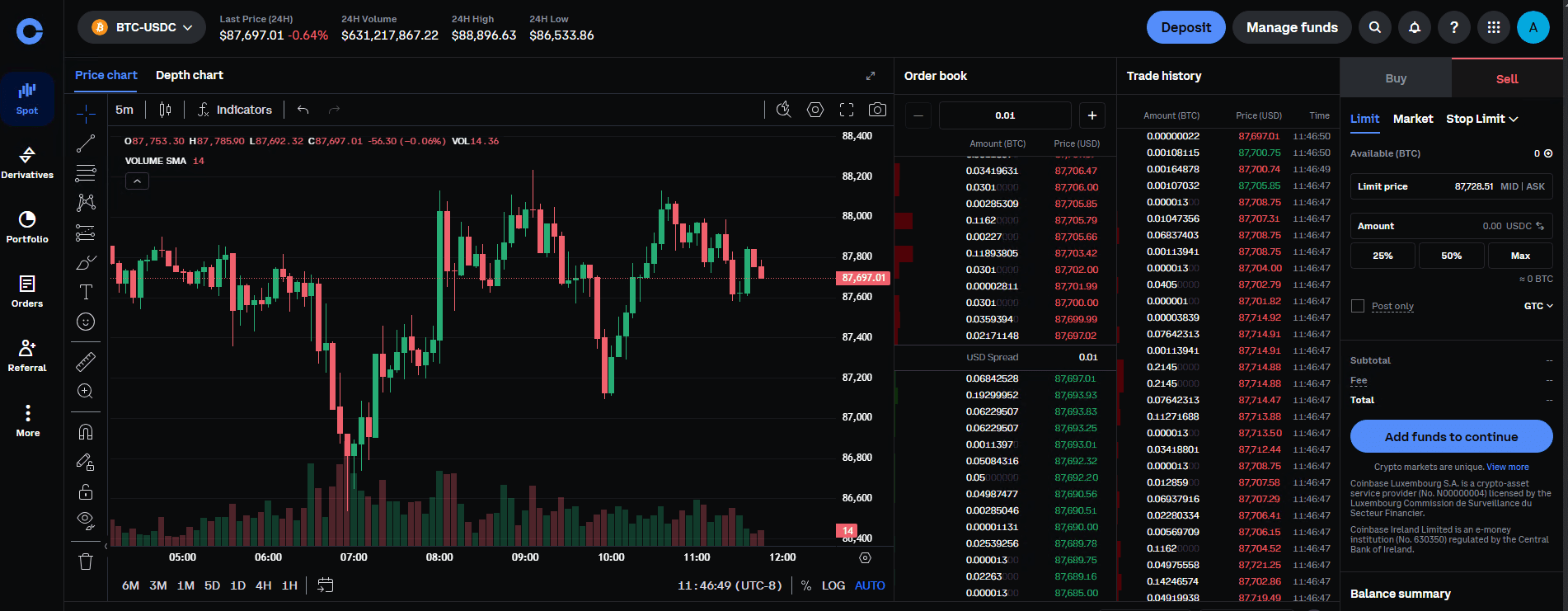

Coinbase Dashboard Overview

The Coinbase dashboard is intentionally simple. Portfolio balances, recent activity, and security notifications are easy to locate. In this Coinbase Review 2026, I found the interface approachable for beginners who may feel overwhelmed by more advanced trading tools.

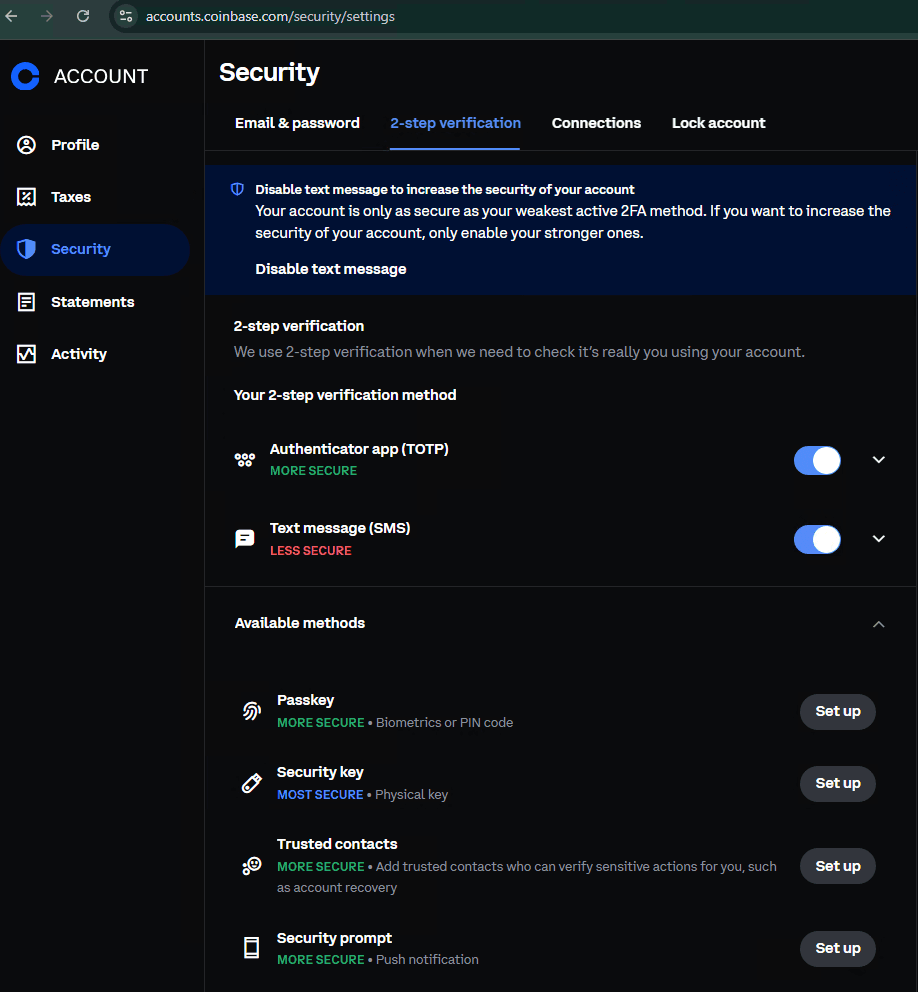

Security Features I Tested

As a DevOps engineer, this is the section I scrutinized the most. Coinbase relies on layered security controls rather than a single mechanism.

Coinbase includes authentication checks, device authorization, and real-time alerts for account activity. Security goes beyond just the exchange. Learn about the best VPNs for trading to protect your account login data.

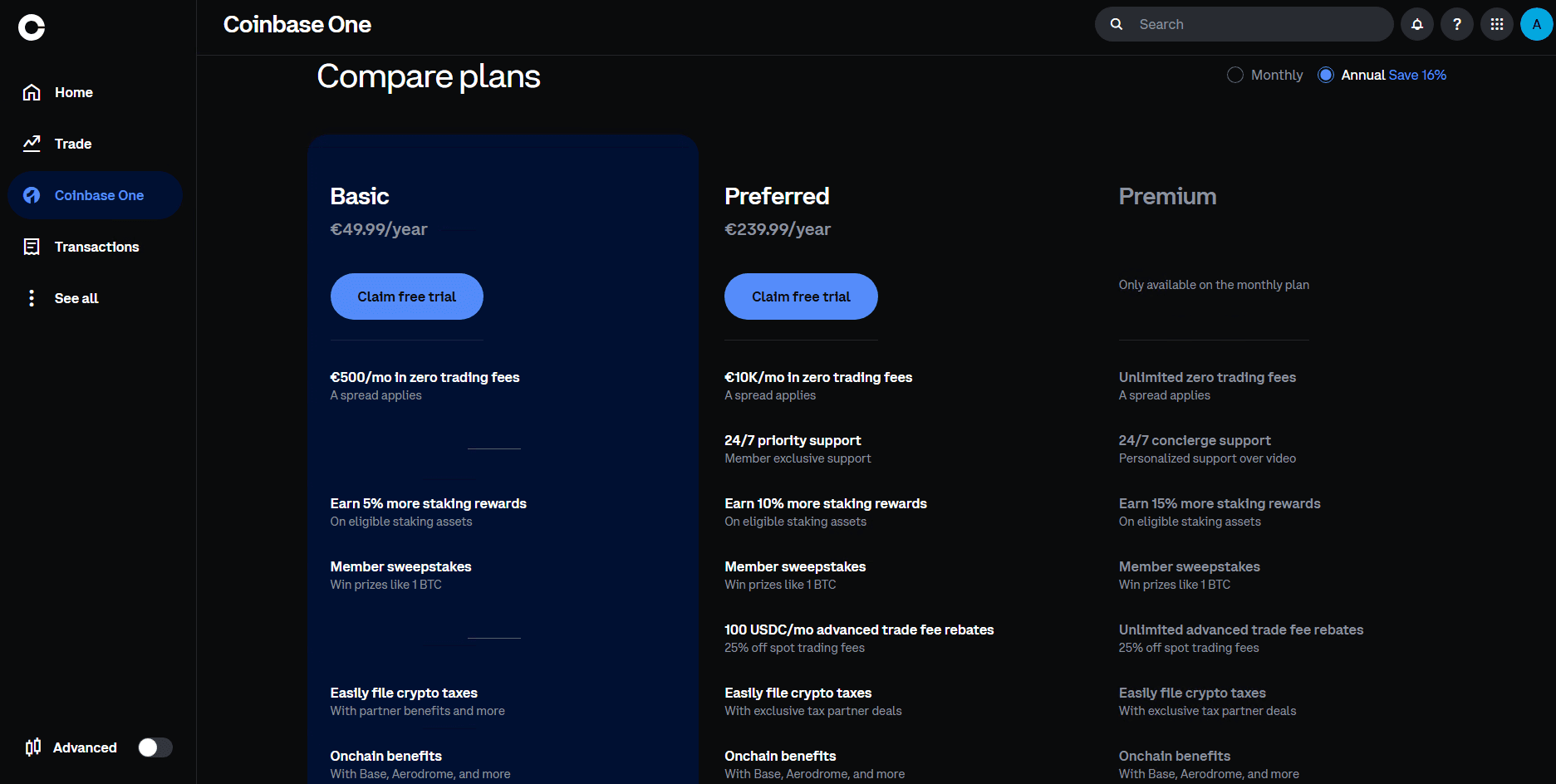

Coinbase Fees in 2026 (And How to Lower Them)

A critical part of any Coinbase Review 2026 is analyzing the costs. Coinbase’s standard interface charges higher fees than many competitors. However, I found a way to significantly lower these costs.

⚠️ The “Fee Hack”: Simple vs Advanced

Most beginners overpay because they use the default “Simple Trade” interface.

- Simple Trade (Convert): Charges a spread of ~2.0% + Fees.

- Advanced Trade: Charges a fixed fee of ~0.4% (Maker) / 0.6% (Taker).

The Fix: Always switch to “Advanced Trade” mode in the settings. It uses the exact same account but saves you significant money.

Quick Fee Comparison (Based on Published Rates)

- Coinbase: Higher standard fees, offset by simplicity and compliance.

- Kraken: Lower fees, more technical interface.

- Binance.US: Competitive fees but regulatory uncertainty.

- Gemini: Security-focused, but lower liquidity.

For more advanced trading needs, compare Exness for forex and CFDs or explore our complete comparison of the best trading platforms.

Coinbase Review 2026: Platform Performance

During testing, the platform felt fast and stable across both desktop and mobile. Navigation between pages and security settings was smooth, with no noticeable lag during peak hours.

My Personal Coinbase Setup

I opened my Coinbase account in November 2025 while building my website and YouTube channel. My goal for this Coinbase Review 2026 was not just to trade, but to learn how regulated crypto exchanges operate and evaluate their security posture.

New to investing? Before you deposit money, use our compound interest calculator to see how regular investments grow over time.

I am using a standard Coinbase account and deliberately avoided Advanced Trade at this stage to understand the beginner experience first. I have not funded the account yet, as I prefer to fully evaluate platform behavior before committing capital.

This cautious approach is intentional. Year-end periods often bring market volatility, and many banks and platforms update policies and fee structures in January. For me, this period made more sense for observation and learning rather than spending.

When I do fund the account, I plan to start with a small test amount using PayPal or a credit card for faster confirmation. My intent is to verify deposit speed, fee transparency, and basic trading execution before scaling any activity.

⚙️ Strategy: How to Automate Your Wealth

I use Google Authenticator as my primary 2FA method, with SMS enabled only as a backup. Email notifications are enabled for all account activity so I receive immediate alerts for logins or security changes.

My Security Testing (DevOps Perspective)

I accessed Coinbase using a Windows desktop and an iPhone to compare behavior across devices. Testing was done from the United States, aligned with Coinbase’s primary regulatory environment.

Logging in from a new device triggered an email alert followed by a 2FA prompt. In most cases, the alert arrived within roughly 30 seconds, though minor delays depended on the receiving mail server.

I did not encounter unexpected login blocks or platform errors during testing. The mobile app also supports an app-level passcode and automatic session timeouts, which adds an extra layer of protection if a device is lost.

What stood out most was Coinbase’s consistent security behavior across web and mobile, combined with its regulatory and compliance posture. While this does not make Coinbase risk-free, it does create a more predictable and transparent environment compared to offshore exchanges.

Would I trust Coinbase with larger funds? Possibly — once I am more confident with long-term platform behavior and fee structure.

FAQ: Common Questions About Coinbase

Is Coinbase safe for US traders?

Yes, Coinbase is a publicly traded company (NASDAQ: COIN) regulated in the US. It holds user funds 1:1 and carries FDIC insurance on USD cash balances up to $250,000.

Why are Coinbase fees so high?

Standard Coinbase charges a spread + fee for convenience. You can lower your fees significantly by using “Advanced Trade” mode, which uses a maker/taker model similar to professional exchanges.

Does Coinbase report to the IRS?

Yes. As a US-regulated exchange, Coinbase provides Form 1099-MISC to users who earn over $600 in crypto rewards/staking and may report trades depending on volume.

Final Verdict: Is Coinbase Worth It in 2026?

This Coinbase Review 2026 concludes that the platform prioritizes security, compliance, and ease of use. It is best suited for beginners and cautious users who want a regulated environment rather than the lowest possible fees.

Maximize your crypto gains: Before you buy, understand your real returns using our Real Yield Calculator.

However, being a beginner doesn’t mean you should be uninformed. Before you start buying assets, make sure you understand the difference between Bitcoin and Bitcoin Gold to avoid costly mistakes.

🚀 The “Smart Money” Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth.

Written by Raheel Ahmed Qureshi

Financial DevOps Expert | Founder of AI Finance Bites

Disclaimer: This article is for educational purposes only and does not constitute financial advice.