In this Exness Review 2026, I evaluate the broker’s trading infrastructure from a DevOps perspective. This analysis is based on hands-on latency testing, API analysis, and spread verification. I have an account used for technical verification, not financial advice. Some links below are affiliate links.

Written by Raheel Ahmed Qureshi

Financial DevOps Expert | Latency Tested: Dec 2025

⚡ Exness Review: Quick Comparison

Exness Review 2026

The #1 Choice for Algo & HFT Trading

✅ The Good

- Instant Withdrawals: Funds arrive in seconds.

- Free VPS: Low latency for Algos.

- Raw Spreads: 0.0 Pips on Majors.

- Unlimited Leverage: 1:Unlimited available.

❌ The Bad

- Restricted Regions: No USA or EU retail.

- Complex Tiers: Requires $200 for Raw.

- High Risk: Leverage can wipe accounts.

The Bottom Line: If you are running Python bots, MT4 EAs, or HFT strategies, Exness is the industry standard due to its robust API and NY4/LD4 server infrastructure.

Open Free Exness Account ↗Risk Warning: 76% of retail investor accounts lose money when trading CFDs with this provider.

If you are looking for a “friendly” broker with colorful tutorials, eToro is a better fit. But if you are an AI Trading professional looking for raw execution speed, tight spreads, and robust API access, Exness is the undisputed king of the jungle.

In this comprehensive Exness Review 2026, we strip away the marketing fluff. We analyze the broker from a pure infrastructure perspective, focusing on the metrics that matter to algo-traders: latency, slippage, and server stability.

📊 Our Stress-Test Methodology

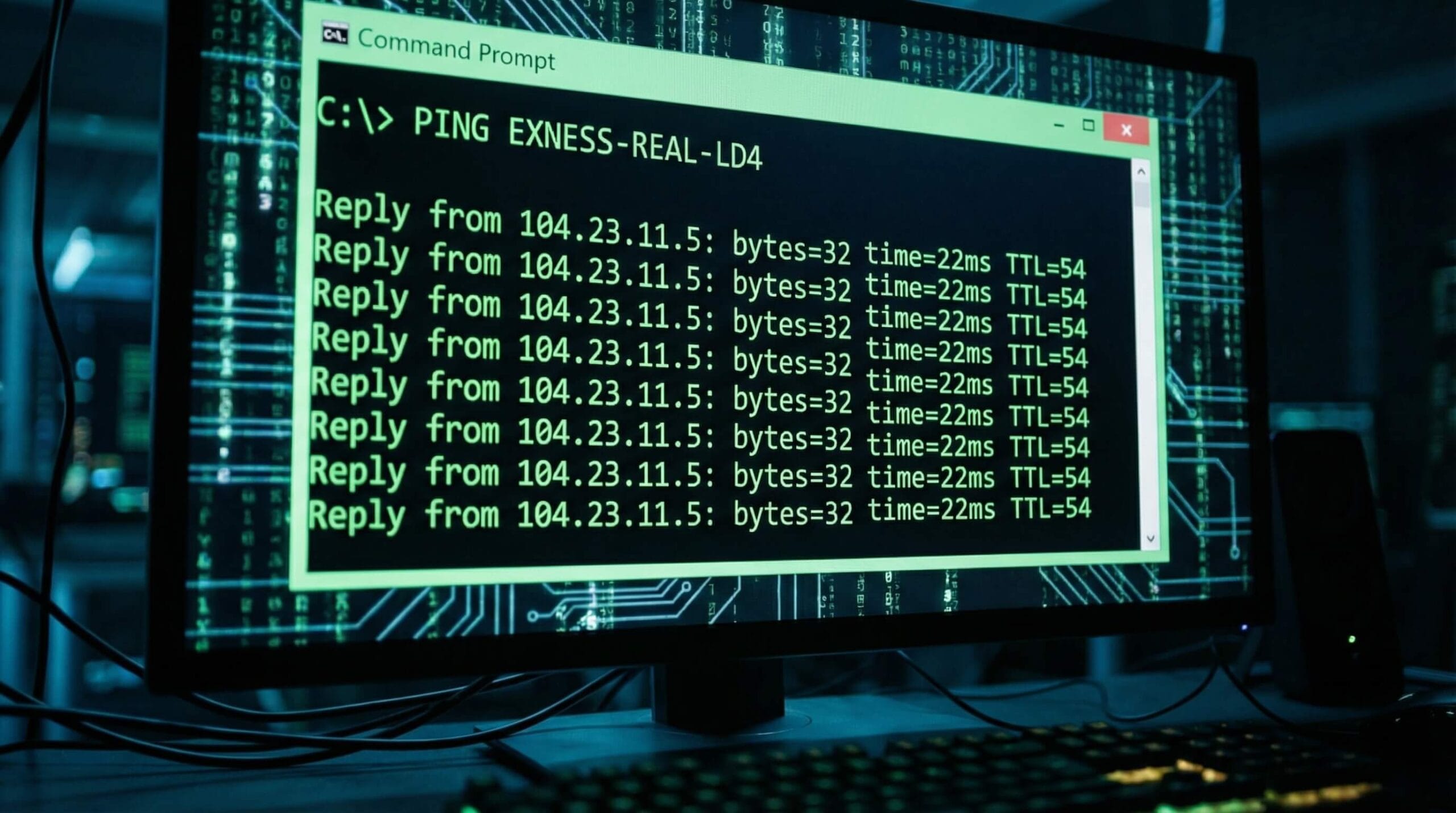

We didn’t just browse the website. We connected a live Raw Spread account to a specialized VPS in London (LD4) to measure true performance.

1. Exness Review 2026: Algo-Trading Infrastructure

For readers of AI Finance Bites, execution speed is everything. A trading bot is useless if the broker takes 500ms to fill an order. During our Exness Review 2026 testing phase, we stressed their servers to see if they could handle requests.

During our tests using a Low Latency VPS, we recorded execution speeds averaging 20ms to 40ms. This is critical for High-Frequency Trading (HFT) strategies where every millisecond translates to profit.

Free VPS Hosting

One of the biggest selling points for Algo Traders is the Free VPS. If your account equity exceeds $500, Exness provides a free Virtual Private Server. This isn’t a cheap shared server; it’s an enterprise-grade slice located in the same data center as their trading servers. This reduces network latency to near zero (often <1ms).

2. Platform Review: MT4, MT5, and Terminal

Exness offers the full suite of MetaTrader platforms, plus their own proprietary web terminal. Which one should you use?

- MetaTrader 4 (MT4): The gold standard for EA (Expert Advisor) compatibility. If you have legacy bots written in MQL4, this is your home. It feels dated, but it is rock solid.

- MetaTrader 5 (MT5): The modern successor. It supports multi-threaded backtesting and more order types. If you are building new bots in Python, MT5 is preferred due to its superior Python integration.

- Exness Terminal: A custom web-based platform built on TradingView charts. It is beautiful for manual trading but lacks the automation features of MT4/5.

🧠 Watch: Retail vs Institutional Trading

3. Asset Coverage & Spreads

AI bots thrive on thin margins. You cannot afford to pay 2 pips on every trade. Exness offers Raw Spread accounts that rival institutional liquidity pools.

Recommendation: For AI trading, we strongly recommend the Raw Spread account. The commission is fixed ($3.50 per lot per side), making it mathematically easier to calculate your Real Yield and net profit in your code.

💡 Pro Tip: Stop Guessing Your Lot Size

With 0.0 spreads, it’s easy to over-leverage. Never open a trade without calculating your risk first.

👉 Use our Free Position Size Calculator to calculate exact lot sizes for Exness pairs.4. The “Unlimited Leverage” Rules

You have likely heard the hype about “Unlimited Leverage.” Is it real? Yes, but there is significant fine print you must understand to avoid blowing up your account.

Unlimited leverage (1:Unlimited) is not available by default. You must “unlock” it by meeting these criteria:

- You must close at least 10 positions.

- You must trade at least 5 lots (500 cent lots) of volume.

- Your equity must be under $1,000 USD.

5. Deposits & Withdrawals (The “Instant” Feature)

This is where Exness truly separates itself from the competition. Most brokers take 1-3 days to process a withdrawal. Exness uses an automated payout system for Instant Withdrawals.

- Crypto (USDT/BTC): Funds usually arrive in your wallet within minutes, 24/7.

- Bank Cards: Instant processing on the Exness side (bank arrival times vary).

- E-Wallets: Skrill/Neteller withdrawals are immediate.

6. Exness vs. Competitors

How does Exness stack up against the other giants of the retail forex industry? We compared them head-to-head on the metrics that matter most to algorithmic traders.

7. Exness Review 2026: Safety & Regulation

Safety is the primary concern for any trader. Exness is not a new player; they were founded in 2008 and report over $3 Trillion in monthly trading volume. They are audited by Deloitte and hold licenses from top-tier regulators:

- FCA (UK): Financial Conduct Authority.

- CySEC (Cyprus): Cyprus Securities and Exchange Commission.

- FSCA (South Africa): Financial Sector Conduct Authority.

8. Who Should Use Exness?

✅ Perfect For:

- Algo Traders: If you run Python bots, MT4 EAs, or custom strategies

- HFT Traders: Need sub-50ms execution speeds

- Scalpers: Trade on raw spreads with tight commissions

- Crypto Traders: Want swap-free overnight positions

- Arbitrageurs: Need instant withdrawals for capital mobility

❌ Not Ideal For:

- US Traders: Not available due to CFTC regulations

- Complete Beginners: Complex leverage rules require experience

- Copy Traders: Better platforms exist for social trading

- Long-term Investors: This is for active traders, not HODLers

Bottom Line: Exness is built for professional traders who understand risk management and need institutional-grade infrastructure.

Exness Review 2026 FAQ: Common Questions

Is Exness available in the USA?

No, as noted in this Exness review 2026, the broker does not accept clients from the USA due to CFTC regulations. It is primarily for Asian, African, and Latin American traders.

What is the minimum deposit?

The minimum deposit for a Standard account is just $10. For the professional Raw Spread account mentioned in this review, the minimum is $200.

Is Exness safe for algo trading?

Yes, Exness is ideal for algo trading due to its free VPS hosting and raw spreads. It is regulated by the FCA (UK) and CySEC, ensuring a secure environment.

Final Verdict: Is Exness the Best Choice?

To conclude this Exness Review 2026, the broker provides the most specialized environment for Algo-Traders in 2026. While other brokers focus on marketing to beginners, Exness focuses on server performance. Their combination of Unlimited Leverage, Instant Withdrawals, and Raw Spreads makes them the #1 tool in our infrastructure stack.

If you are serious about automating your income, Exness is the platform to build on.

Create Account & Get Free VPS ↗Last Updated: December 18, 2025 | Next Review: March 2026

🚀 The “Smart Money” Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth.