Risk Calculator 🛡️

Never blow your account again.

$0

(You risk losing: $0)

Plan your trade before you take it.

GET PRO CHARTS ON TRADINGVIEW ↗Get the 2% Risk Management Checklist sent to your email: 👇

Using a Position Size Calculator is the single most effective habit of profitable traders. While amateurs obsess over “entry signals” and technical indicators, professionals obsess over risk management. If you don’t know exactly how much to buy before you click that button, you are gambling, not trading.

This free tool helps you instantly calculate the correct lot size or contract amount based on your account balance and stop loss distance, ensuring you never risk more than you can afford to lose.

Why You Need a Position Size Calculator

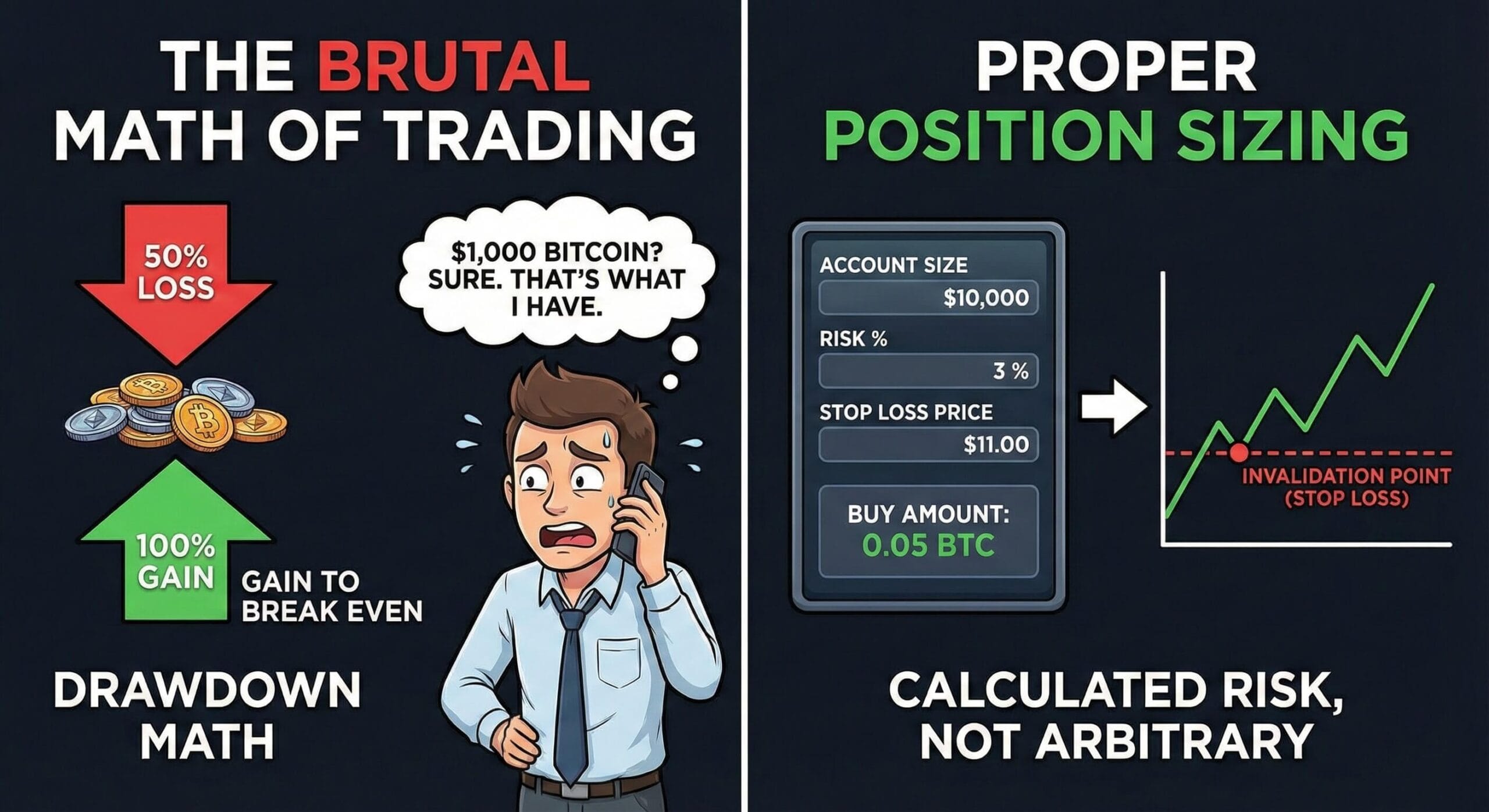

The math of trading is brutal. If you lose 50% of your account, you need a 100% gain just to break even. This is known as “drawdown math.”

Most retail traders blow their accounts because they use arbitrary position sizes. They might buy $1,000 worth of Bitcoin simply because “that’s what they have in their wallet.” A proper Position Size Calculator reverses this logic: it tells you how much to buy based on where your invalidation point (Stop Loss) is.

The 2% Rule Explained

The golden standard in our Risk Management Trading strategy is the 2% Rule. This rule states you should never risk losing more than 2% of your total account equity on a single trade idea.

- Account Balance: $10,000

- Max Risk (2%): $200

This doesn’t mean you only buy $200 worth of stock. It means if your trade hits the Stop Loss, your loss is $200. Our calculator handles this math for you instantly.

How to Use This Tool

- Account Balance: Enter your total trading capital (e.g., $1,000).

- Risk %: Enter your risk tolerance (Recommended: 1% to 2%).

- Stop Loss %: Measure the distance from your entry price to your Stop Loss on the chart.

The tool will output your Max Position Size. This is the dollar amount of the asset you should purchase.

The Math Behind the Calculation

Understanding the formula helps you trust the data. As defined by Investopedia, position sizing is the technique of determining how many units to trade to control risk.

Formula: (Account Balance × Risk %) ÷ Stop Loss % = Position Size

For example, if you have $1,000 and want to risk 2% ($20) on a trade with a 5% stop loss, the math is: $20 ÷ 0.05 = $400.

Common Mistakes to Avoid

Even with a Position Size Calculator, traders make mistakes. The most common is moving the Stop Loss to “fit” a desired position size. This is dangerous. Always determine your Stop Loss based on market structure (Support/Resistance) first, then calculate your size second.

FAQ: Frequently Asked Questions

Does this work for Crypto and Forex?

Yes. This calculator works for any asset class (Stocks, Crypto, Forex) because it uses percentages. Math is universal.

Why is my position size larger than my balance?

If your Stop Loss is very tight (e.g., 0.5%), the calculator might tell you to buy $5,000 worth of stock even if you only have $1,000. This implies you need Leverage to take the trade responsibly. Be careful with leverage.

What is the best risk percentage for beginners?

We recommend beginners start with 1% risk per trade. This allows you to survive a 20-trade losing streak and still have over 80% of your capital left.

Conclusion

Trading without a plan is just expensive entertainment. Use this Position Size Calculator before every single trade execution. It takes 5 seconds, but it will save your portfolio from the inevitable “bad trade” that wipes out the gamblers.

Disclaimer: This tool is for educational purposes only. Trading involves significant risk.