Real Yield Calculator: Why Your 5% Savings Account is Losing Money

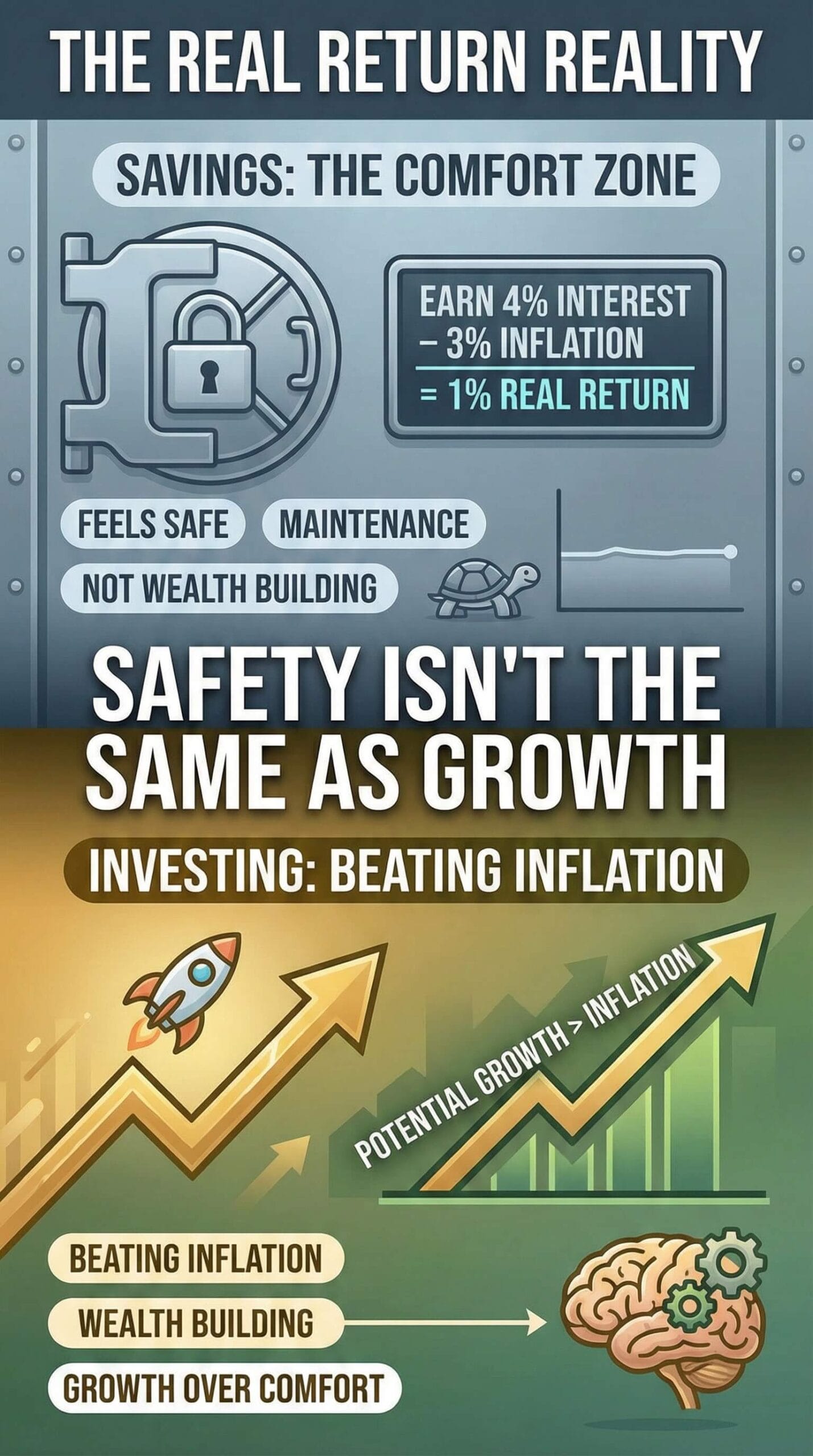

You did the responsible thing. You put your money in a High-Yield Savings Account (HYSA) earning 5% interest. You feel safe. But once you subtract inflation and taxes, the math tells a different story.

Most investors confuse “Nominal Yield” (the advertised rate) with “Real Yield” (your actual purchasing power). This calculator reveals the truth about your savings.

Real Yield Calculator

The “Silent Killer” Formula (The Math)

Why is your return lower than you expected? Most people use simple subtraction to guess their yield, but professional investors use the Fisher Equation.

There are two distinct forces destroying your wealth:

- Taxes First: The government taxes your gain immediately. If you earn 5% interest and are in a 24% tax bracket, you only keep 3.8%. The IRS does not care about inflation; they tax the “Nominal” number.

- Inflation Second: That remaining 3.8% must then compete with the rising cost of goods. If inflation is 3.5%, your purchasing power is effectively zero.

(1 + Real Rate) = (1 + Nominal Rate) / (1 + Inflation Rate)

To learn more about the technical side of this calculation, you can read the definition of the Fisher Effect on Investopedia.

Historical Context: Are We in Danger?

Many investors today have “Recency Bias.” They remember the low-inflation era of 2010-2020 where checking accounts paid nothing, but inflation was also near zero. We are now entering a different economic regime.

During the 1970s, inflation spiked above 12%. Banks raised rates to match, but real yields remained negative for nearly a decade. Today, with government debt at record highs, “Financial Repression” (keeping interest rates below inflation) is a common tool used by central banks to inflate away debt. You can check the current official CPI numbers directly at the Bureau of Labor Statistics (BLS).

How to Fix Your Yield

If the Real Yield Calculator shows a red result, you cannot “save” your way to wealth. You must invest. To generate positive Real Yield, you generally need to move further out on the risk curve or optimize for tax efficiency.

1. Tax-Advantaged Accounts

One of the easiest ways to boost real yield is to remove the tax drag. Using a Roth IRA or 401(k) protects your nominal gains from the IRS, allowing the full interest rate to fight inflation.

2. Hard Assets (Gold & Bitcoin)

Fiat currency is designed to depreciate. Hard assets are designed to appreciate. Allocating a percentage of your portfolio to assets with a fixed supply is the historical hedge against negative real rates.

3. Equities (The S&P 500)

Companies can raise prices. When inflation hits, Coca-Cola and Apple charge more for their products. This is why the stock market historically returns 10% (or ~7% Real Yield) over long periods.

Want to beat inflation automatically?

I use a specific stack of Broker + VPS + Bot to generate real yield 24/7.

View My Full Setup ↗🎥 Watch: The Inflation Trap Explained

(Vertical Video Format)

🚀 The “Beat Inflation” Toolkit

The exact tools I use to protect purchasing power and generate yield.

Real Yield FAQs

Is a 5% interest rate good?

It depends entirely on the inflation environment. If inflation is 2%, a 5% rate is excellent because you have a 3% Real Yield. However, if inflation is 9% (as seen in recent years), a 5% rate is terrible because your Real Yield is -4%.

What is the safest hedge against inflation?

Historically, Gold and Real Estate are considered the safest hedges. In the modern digital age, Bitcoin is increasingly viewed as “Digital Gold” due to its fixed supply cap of 21 million coins.

Does the calculator account for state taxes?

Yes. In the “Tax Rate” field, you should enter your combined marginal tax rate (Federal + State). For most middle-class Americans, this is between 22% and 32%.