💸 Watch: How to Keep More of Your Trading Profits

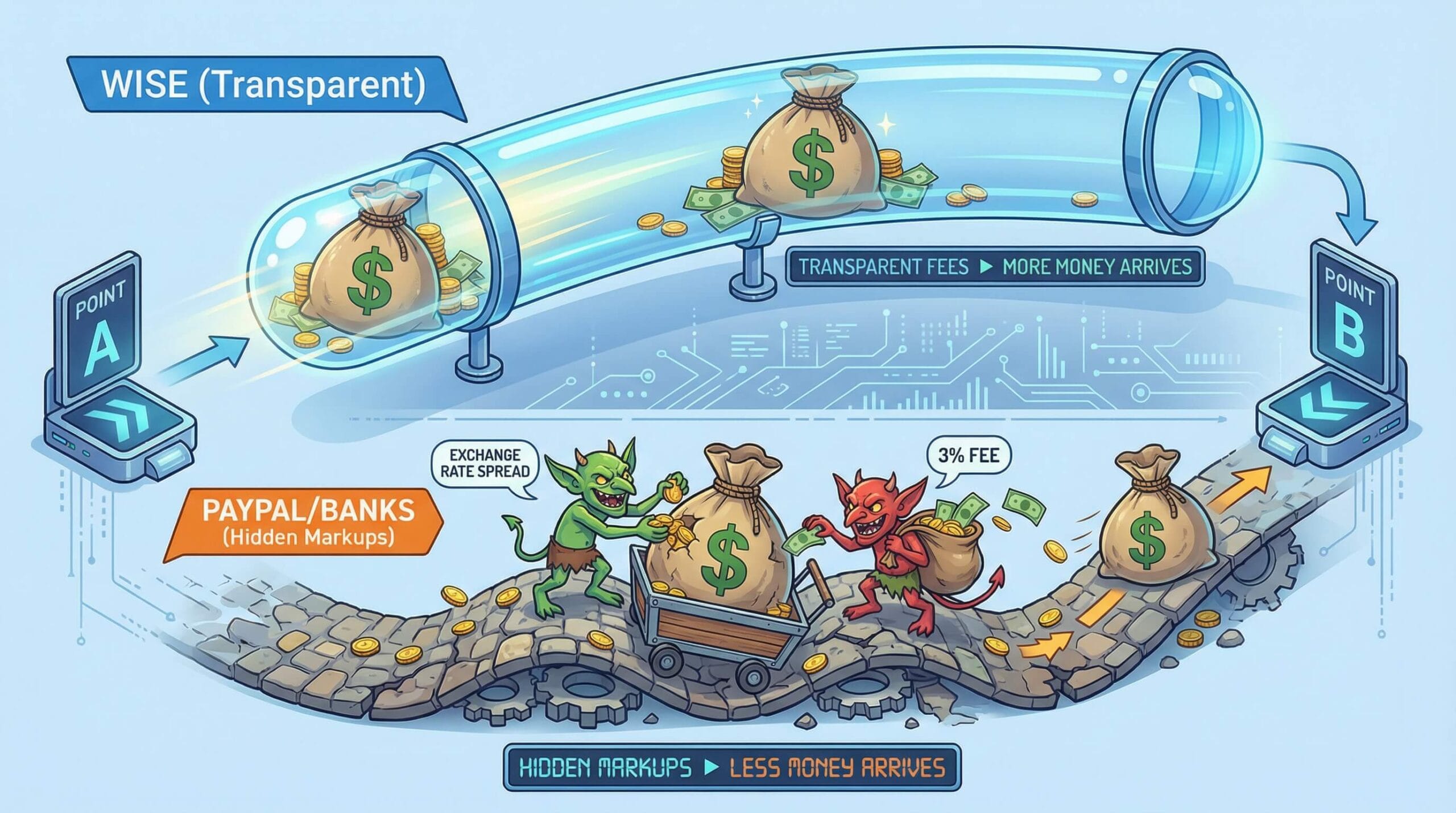

If you are looking for the definitive Wise vs PayPal for traders comparison in 2026, the math is shocking. If you use PayPal to withdraw your trading profits from brokers like Exness, you are likely losing 3-5% in hidden currency conversion fees.

For a hobbyist withdrawing $100, this doesn’t matter. But for a high-volume trader moving $10,000 or more, using the wrong platform adds up to thousands of dollars in lost profit every single year.

In this guide, we break down the Wise vs PayPal for traders debate with real numbers, showing you exactly how to stop donating your hard-earned gains to payment processors.

The “Real Exchange Rate” Secret

Traditional banks and PayPal use a “marked-up” exchange rate. They might advertise a “$0 Transaction Fee,” but they hide their profit in the spread.

For example, if the real exchange rate for USD to EUR is 0.95, PayPal might give you 0.91. That 4% difference is a hidden tax on your Real Yield. The solution is AI-driven routing used by modern fintech platforms like Wise.

Wise vs PayPal for Traders: The Fee Breakdown

Let’s look at the numbers for a hypothetical $5,000 withdrawal from a broker to a local bank account.

| Feature | PayPal | Wise (TransferWise) |

|---|---|---|

| Exchange Rate | Marked up (3-4% Spread) | Real Mid-Market Rate |

| Transfer Fee | Often “Free” (Misleading) | ~0.5% (Transparent) |

| Speed | Instant to 1 Day | Instant to 2 Days |

| Cost on $5,000 | ~$200 Lost | ~$35 Lost |

As you can see in the comparison above, choosing Wise effectively puts an extra $165 in your pocket for a single transaction. This clearly settles the Wise vs PayPal for traders cost argument: Wise is mathematically superior.

Why We Recommend Wise (Formerly TransferWise)

Wise uses the mid-market exchange rate (the one you actually see on Google). They charge a transparent fee upfront, usually around 0.5% – 0.7%, and never hide costs in the exchange rate.

For traders, Wise offers specific advantages:

- Dedicated US Bank Details: You get a real Routing and Account number to receive USD from brokers like a local.

- High Limits: Unlike PayPal which often freezes large transactions for security checks, Wise is built for international transfers.

- Broker Integration: Many platforms like Interactive Brokers and Exness integrate smoothly with Wise routing.

The 3-Step Withdrawal Strategy

Here is the exact workflow smart traders use to bypass fees. This strategy works specifically because it avoids the dynamic currency conversion (DCC) traps common in PayPal.

- Withdraw USD: Request a withdrawal from your broker to your Wise USD Account details (via ACH or Wire). Do not ask the broker to convert it.

- Convert Instantly: Once the USD lands in Wise, convert it to your local currency (EUR, GBP, INR, etc.) inside the app.

- Local Transfer: Send the converted funds to your local main bank account. This is usually free and instant.

You can verify these fee structures directly on the official Wise Pricing Page and the PayPal Fees Page.

Wise vs PayPal for Traders FAQs

Is Wise better than PayPal for traders?

Yes. When comparing Wise vs PayPal for traders, Wise wins on cost. PayPal charges 3-4% spread fees, while Wise charges ~0.5% and uses the real mid-market rate.

Does Exness accept Wise withdrawals?

Yes. While Exness may not have a “Wise Button,” you can withdraw via “US Bank Transfer” by entering the unique ACH account details provided by your Wise USD account.

Is Wise safe for large amounts?

Wise is a regulated financial institution (like a bank) in multiple jurisdictions (FCA, FinCEN). They safeguard funds in top-tier banks and are generally considered very safe for large transfers.

🚀 The “Smart Money” Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth.