🏠 Watch: Renting vs Buying (The Math Breakdown)

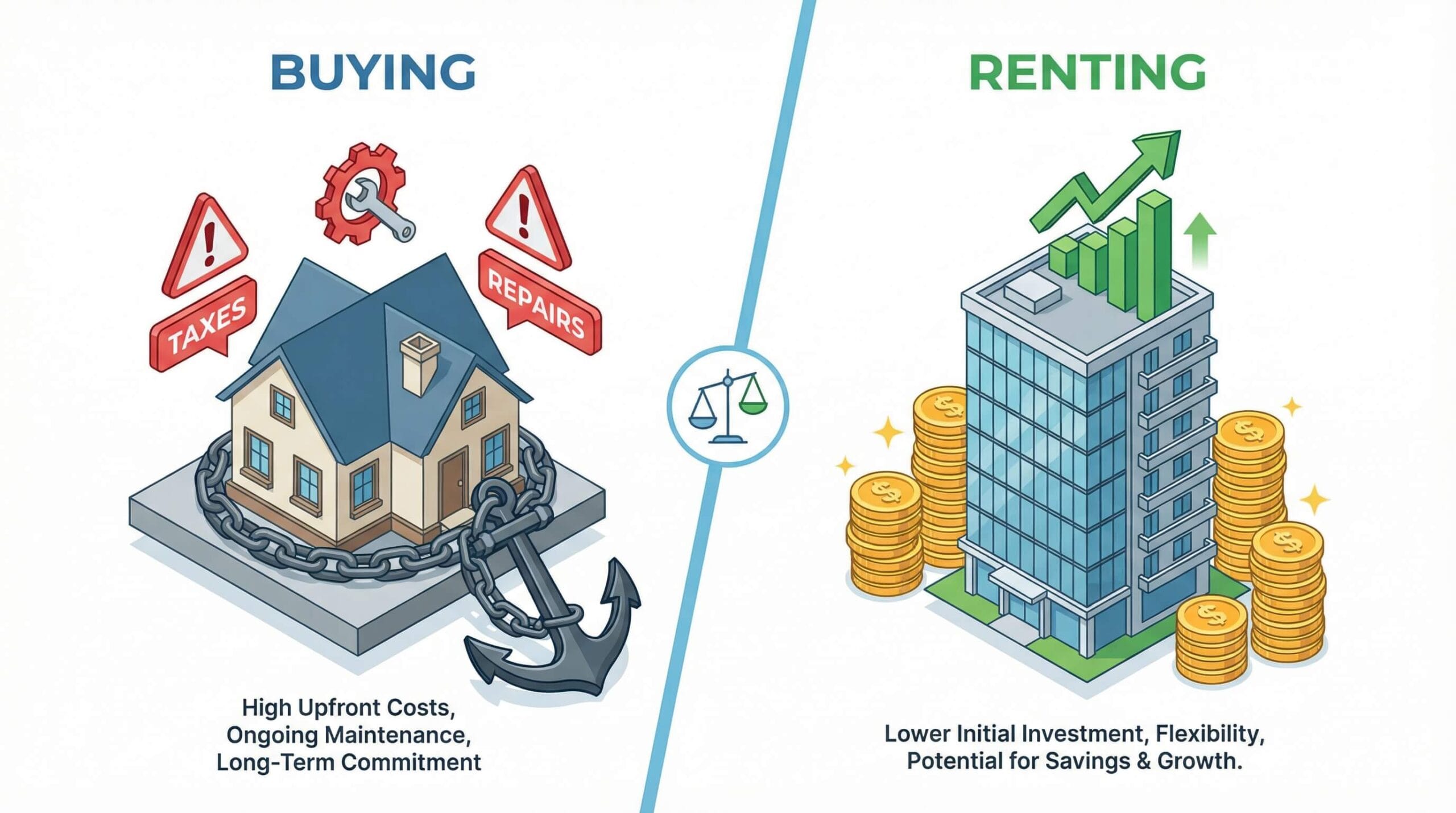

The Rent vs Buy Math has changed drastically in 2025, yet the “American Dream” has drilled one message into our heads for decades: “Renting is throwing money away. Buying is building equity.”

But in the current economic environment of high interest rates and inflated asset prices, this conventional wisdom is not just wrong—it is dangerous. When you actually sit down and run the Rent vs Buy math, you realize that for millions of people, buying a home right now isn’t an investment; it is a liability that traps their net worth.

Before you sign a 30-year mortgage, let’s look at the actual numbers that real estate agents don’t want you to see.

The “Throwing Money Away” Myth

The argument goes like this: “When you pay rent, you give money to a landlord and get nothing back. When you pay a mortgage, you pay yourself.”

This ignores one massive factor in the Rent vs Buy math equation: Unrecoverable Costs.

When you own a home, a huge portion of your monthly payment does not build equity. It vanishes. It goes to the bank (interest), the government (taxes), and the house itself (maintenance). These are costs you never see again, exactly like rent.

The 5% Rule: The Costs You Never Get Back

Financial expert Ben Felix popularized the “5% Rule” to estimate the true unrecoverable cost of owning a home. This is a critical component of Rent vs Buy math that most buyers overlook.

Even if you pay off your mortgage, you still lose roughly 5% of the home’s value every single year to:

- Property Taxes: usually 1% – 2% of the home’s value annually.

- Maintenance Costs: 1% annually (roofs, boilers, and painting don’t pay for themselves).

- Cost of Capital: 3% (The opportunity cost of tying up your down payment).

If you buy a $500,000 house, your “Phantom Costs” are roughly $25,000 per year (or $2,083/month). If you can rent a similar house for less than $2,083/month, the Rent vs Buy math favors renting.

The Opportunity Cost (The S&P 500 Factor)

This is where the wealthy separate themselves from the middle class. The “Renters” who win are the ones who invest the difference.

When you buy a house, you have to put down a massive down payment (say, $100,000). That money is now “dead equity.” It sits in the walls of your house, growing at the rate of real estate inflation (historically 3-4%).

If you took that same $100,000 and put it into the S&P 500 (historically 10% returns), the compound interest over 30 years is staggering.

Real World Example: The Rent vs Buy Math on $500k

Let’s run a 30-year scenario comparing two people using the standard NYT Calculator logic:

- The Buyer: Puts $100k down on a house. Pays mortgage, taxes, and repairs. House appreciates 4%.

- The Renter: Puts $100k into the Stock Market. Rents a similar place. Invests the monthly savings between the cheaper rent and the expensive mortgage. Stocks appreciate 10%.

In almost every major city where Rent-to-Price ratios are high (like New York, LA, or Toronto), The Renter ends up with a higher Net Worth after 30 years. Why? Because the stock market outpaces real estate, and the Renter had more liquidity working for them.

The Verdict: When Should You Actually Buy?

I am not saying “never buy a house.” Buying makes sense if:

- You plan to stay for 10+ years (spreading out closing costs).

- You want control over your living space (renovations/stability).

- You are in a market where rent is absurdly high compared to home prices.

But do not buy purely as an “investment.” A house is a place to live. Stocks are an investment. Confusing the two is a great way to be “House Poor” for the rest of your life.

Rent vs Buy Math FAQs

Is renting always throwing money away?

No. When you analyze the Rent vs Buy math, renting buys you flexibility and a place to live. Buying involves “throwing money away” on unrecoverable costs like property tax, interest, and repairs.

What is the 5% Rule in real estate?

The 5% Rule helps calculate Rent vs Buy math quickly. It states that the annual unrecoverable cost of owning a home is roughly 5% of its total value. If annual rent is less than 5% of the home price, renting is cheaper.

💡 Related Analysis: Worried about where the economy is heading before you make a big purchase? Read our breakdown of the Yield Curve Inversion to see why a recession might be closer than you think.

🚀 The “Smart Money” Toolkit

The exact tools we use to analyze markets, trade assets, and protect wealth.